Calculate take home pay georgia

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Take home pay calculator georgia.

Georgia Paycheck Calculator Smartasset

Total annual income Tax liability.

. Take home pay calculator GA. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The easiest way to achieve a salary increase may be to simply ask for a raise promotion or bonus.

Married filers no dependent with an annual income of 112400 will take home 8830815 after income taxes. Your average tax rate is 1797 and your marginal tax. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Figure out your filing status. So if you earn 10 an hour enter 10 into the salary input and select Hourly.

If you make 149120 a year living in the region of New York USA you will be taxed 36464. Georgia Hourly Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

New York Income Tax Calculator 2021. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia.

Georgia Salary Paycheck Calculator. All you have to do. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. For example if an employee earns 1500 per week the individuals. How to Increase a Take Home Paycheck.

For example if an. For example if an. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Work out your adjusted gross income. Our 2022 GS Pay Calculator allows you to calculate the exact salary. Calculating paychecks and need some help.

Need help calculating paychecks. Supports hourly salary income and multiple pay frequencies. Optional Select an alternate state.

This free easy to use payroll calculator will calculate your take home pay. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. There is no local tax for Georgia residents therefore this calculator calculates Federal income tax social security tax medicare tax and state tax.

Enter your salary or wages then choose the frequency at which you are paid. However this is assuming that. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees.

First you need to determine your filing status to. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

State Corporate Income Tax Rates And Brackets Tax Foundation

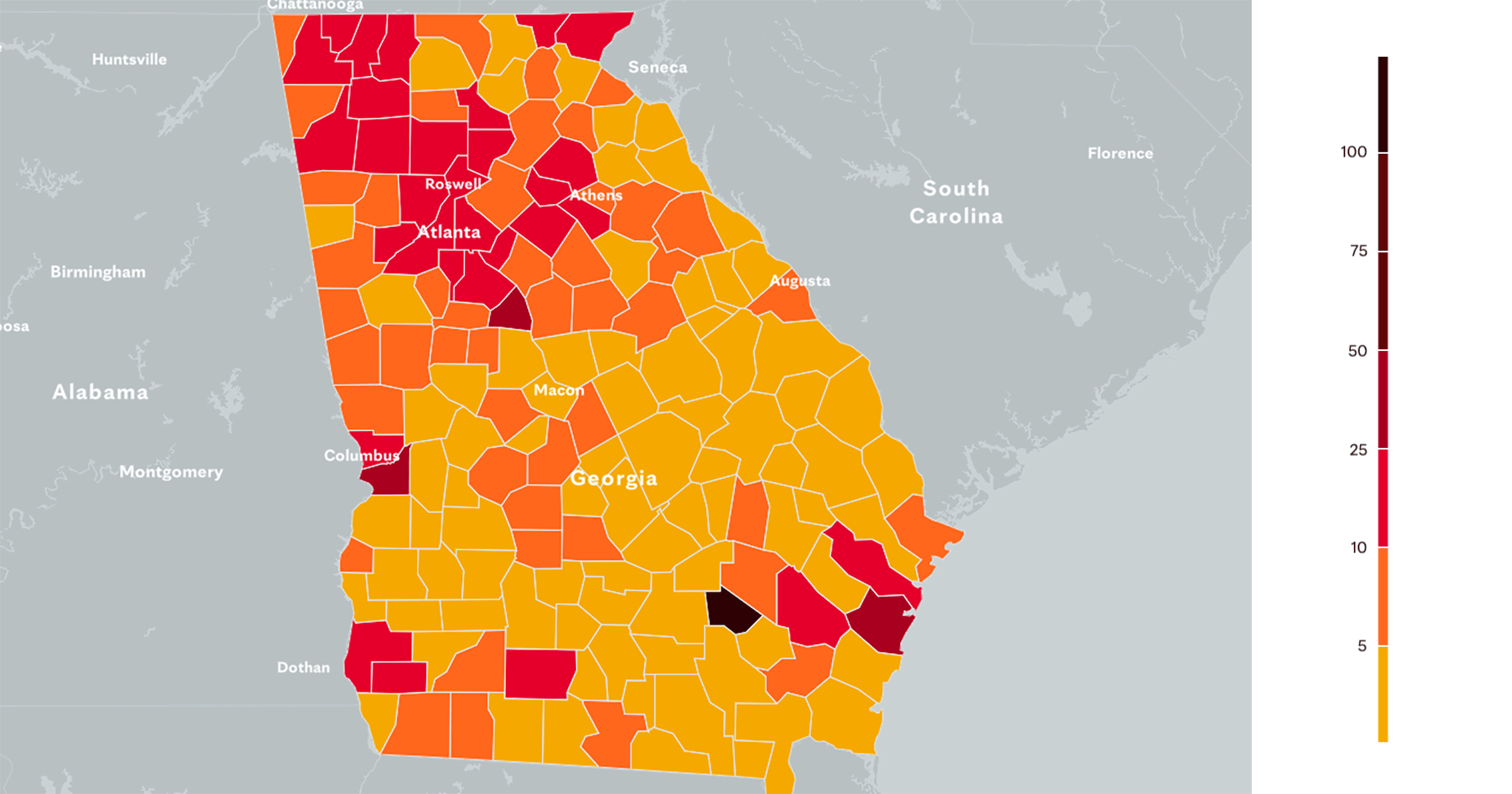

Georgia Covid 19 Map Tracking The Trends

Sales Tax On Grocery Items Taxjar

Georgia Income Tax Calculator Smartasset

University Of Georgia

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Georgia Paycheck Calculator Smartasset

Georgia Coronavirus Map And Case Count The New York Times

![]()

Georgia Coronavirus Map And Case Count The New York Times

Georgia Traveler View Travelers Health Cdc

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Georgia Coronavirus Map And Case Count The New York Times

Sales Tax Calculator Taxjar

Gross Pay Vs Net Pay What S The Difference Adp

Sales Tax Calculator Taxjar