Calculate my salary after taxes

Free tax code calculator. If youve already paid more than what you will owe in taxes youll likely receive a refund.

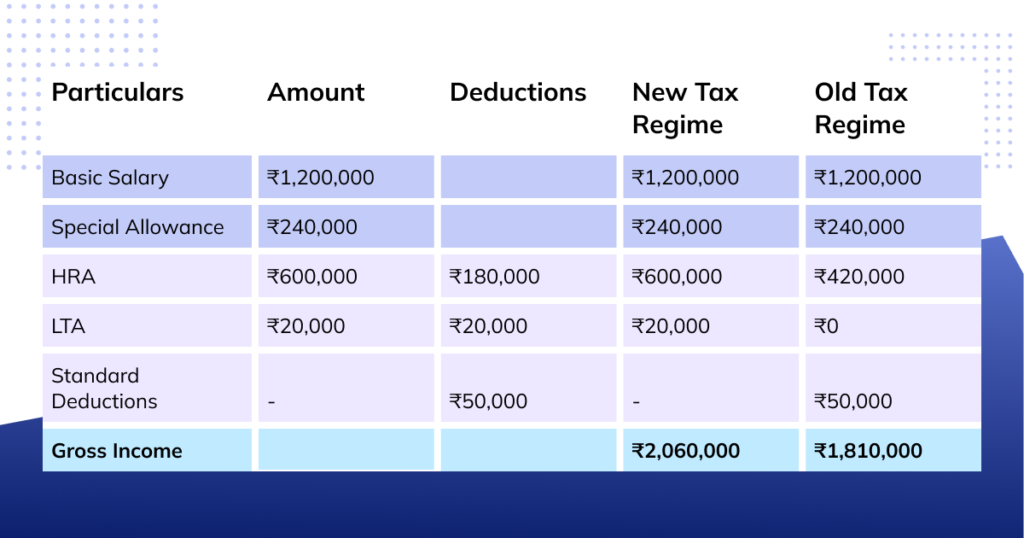

How To Calculate Income Tax On Salary With Example

Whatever Your Investing Goals Are We Have the Tools to Get You Started.

. Gross pre-tax Income Per. Whatever Your Investing Goals Are We Have the Tools to Get You Started. This means that after tax you will take home 2573 every month or 594 per week.

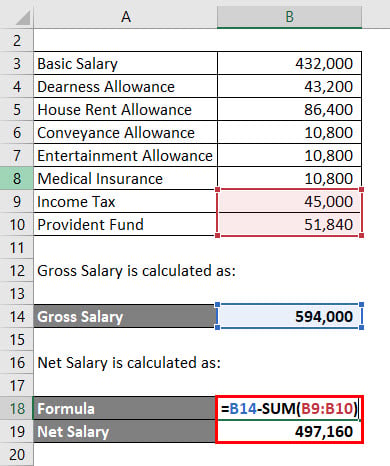

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The money that you put. If your salary is 40000 then after tax and national insurance you will be left with 30879.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Choose Your Paycheck Tools from the Premier Resource for Businesses. Ad Discover Helpful Information And Resources On Taxes From AARP.

New Zealands Best PAYE Calculator. That means that your net pay will be 40568 per year or 3381 per month. Reduce tax if you wearwore a uniform.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. That means that your net pay will be 43041 per year or 3587 per month.

That means that your net pay will be 37957 per year or 3163 per month. For example lets assume an individual makes an annual. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate.

How to calculate annual income. This places US on the 4th place out of 72 countries in the. Your average tax rate is.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. How to use the Take-Home Calculator. Choose Your Paycheck Tools from the Premier Resource for Businesses.

It can also be used to help fill steps 3 and 4 of a W-4 form. Youll then see an estimate of. This reduces the amount of.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. For example if an employee earns 1500.

For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a. Transfer unused allowance to your spouse. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

Your average tax rate is. Input the date of you last pay rise when your current pay was set and find out where your current salary has. If you are earning a bonus payment one month.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Calculate your take home pay from hourly wage or salary. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

One option that Nevadans have to shelter more of their paycheck from Uncle Sam is to put more money into pre-tax retirement accounts such as a 401k or 403b. Your average tax rate is. Well calculate the difference on what you owe and what youve paid.

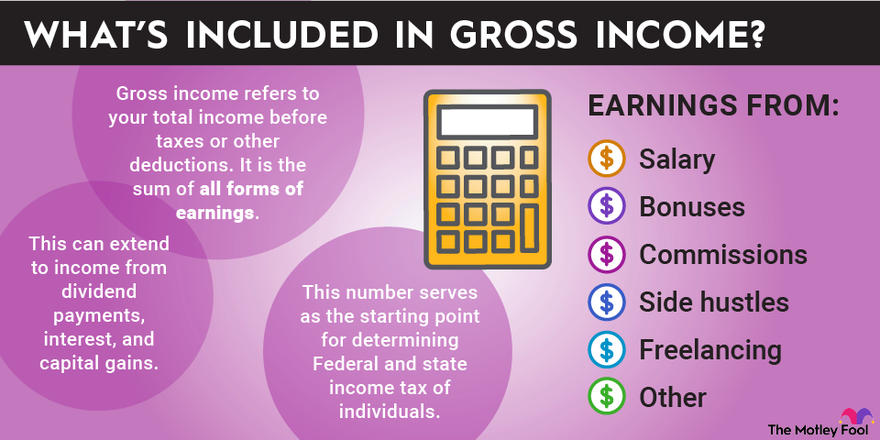

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Adjusted gross income - Post-tax deductions Exemptions Taxable income. To calculate the after-tax income simply subtract total taxes from the gross income.

It comprises all incomes. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This places Ireland on the 8th place in the International.

See your tax refund estimate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Check your tax code - you may be owed 1000s.

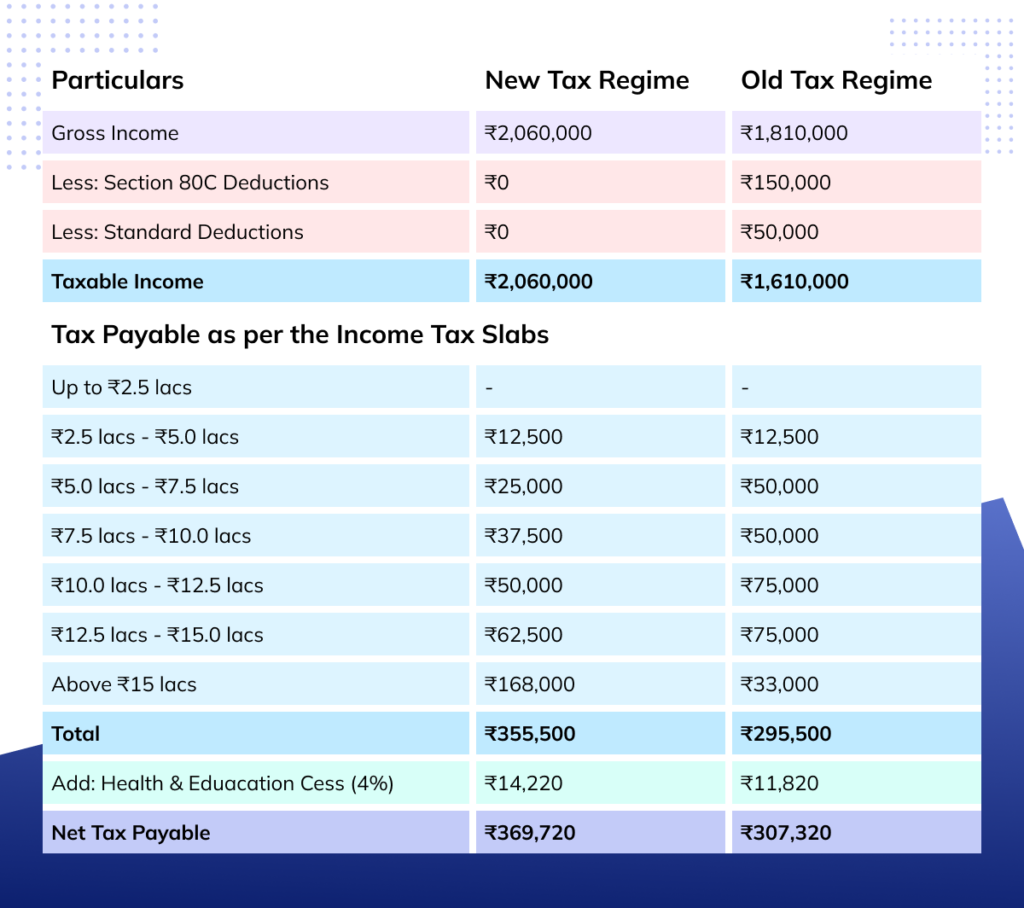

Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the. If you make 55000 a year living in the region of New York USA you will be taxed 11959. How do you calculate pre tax salary for a company.

Taxable income Tax rate based on filing status Tax liability. How Income Taxes Are Calculated. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Use this calculator to see how inflation will change your pay in real terms. Companies can back a salary into an hourly wage.

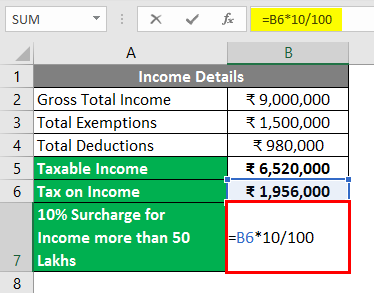

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

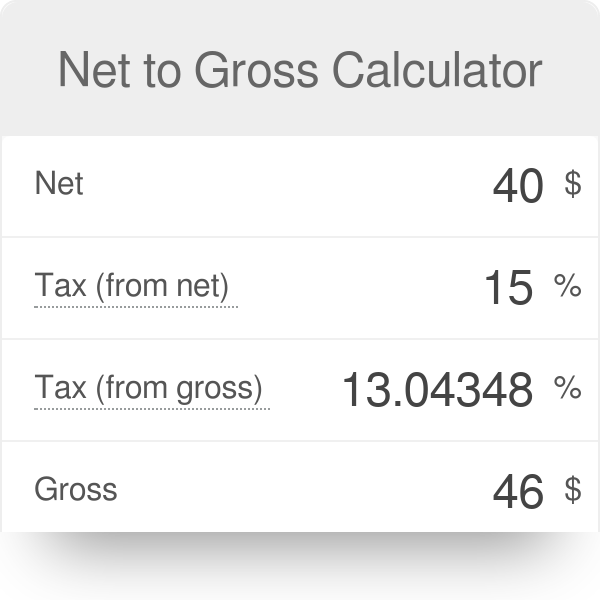

Net To Gross Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

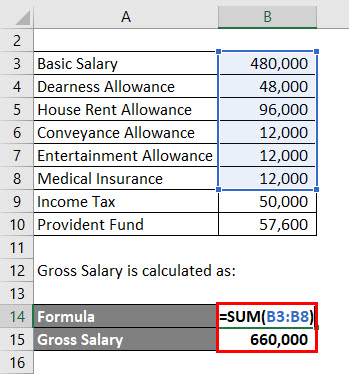

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Gross Income Per Month

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Salary Formula Calculate Salary Calculator Excel Template

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator